Introduction to eChecks

Today, with modern technology, there are more methods of payment than ever before. If you have not yet heard of eChecks, get ready, they are the way of the future. With so many transactions taking place online, safe and reliable electronic payment is not a luxury but a necessity.

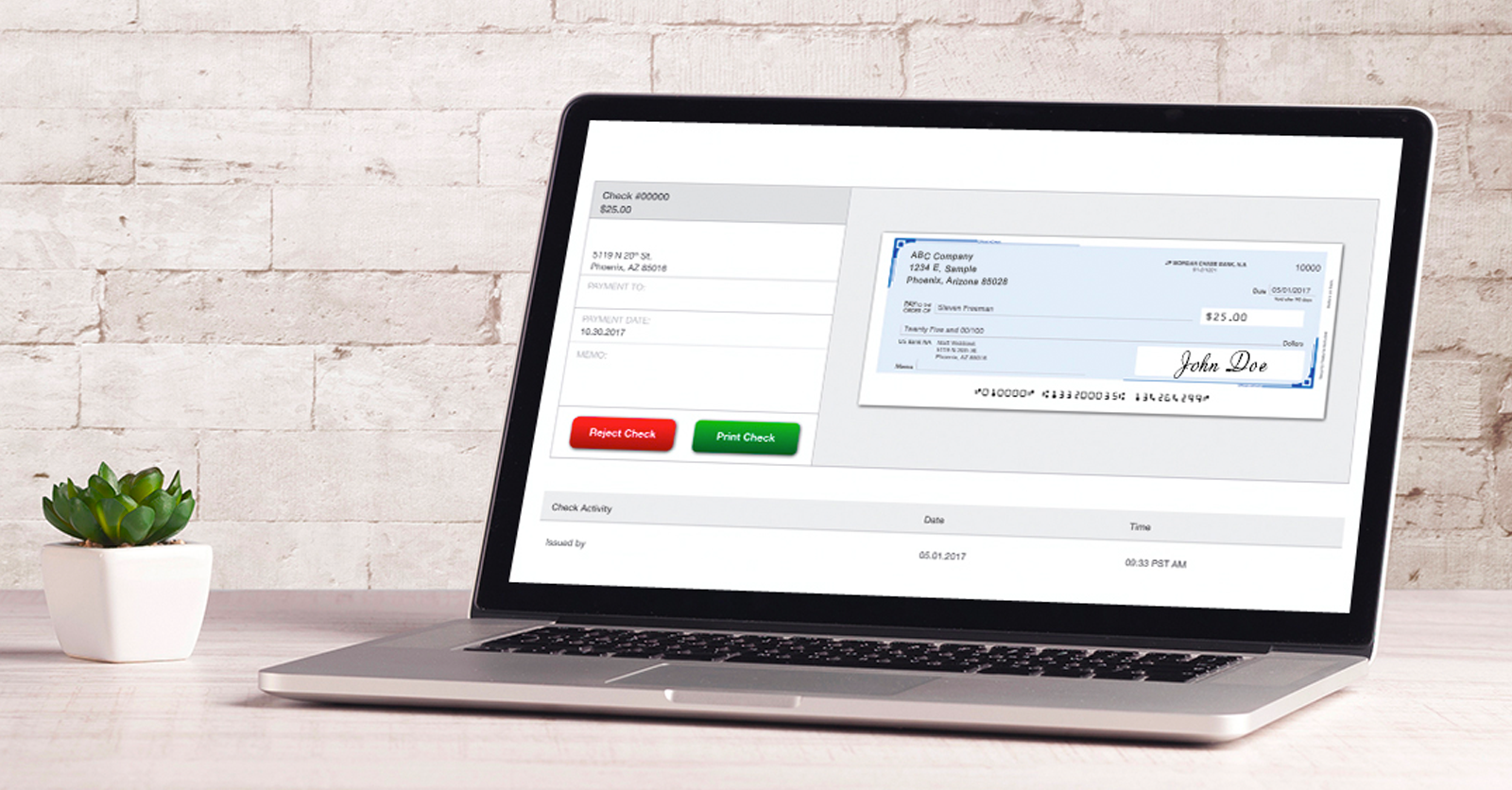

What is an eCheck?

An eCheck is much like a traditional check but there is no paper involved. The eCheck is a paper check that is sent electronically and can be printed on any printer or electronically deposited to your bank. An eCheck does not work like an instant transfer of funds. Echecks are instantly delivered electronically, secure, and significantly cut down on lost checks and fraud. Like all electronic transactions, eChecks have evolved over time. Quickbooks elaborates on how an eCheck works today, “An e-check is an electronic or digital version of a paper check. Like a paper check, an e-check requires standard information in order to use the e-check for payment. Specifically, an e-check includes a routing number, bank account number, the name on the bank account, a signature, and endorsement. Further, e-checks are also deposited and settled like paper checks.”

ValidCheck Fraud Protection

ValidCheck eChecks are not only a convenient service to use for issuing and processing eChecks, but ValidCheck takes fraud protection a step further. ValidCheck automatically uploads check data directly to your bank’s teller system by partnering with your financial institution and utilizing Positive Pay. If the information uploaded does not exactly match the information on the check, the bank will not cash the check. This provides virtually 100% fraud protection as long as you are using ValidCheck with Positive Pay. The other benefit of this is that the teller isn’t required to go to a 3rd party website or call a number to verify the validity of the check like some other eCheck providers. It’s all right there in front of them on the tellers screen.

The other benefit of ValidCheck with Positive Pay is that the funds are IMMEDIATELY available if the check is presented to the issuing financial institution. No holds, no calls to verify the check, no hassles. Your payees get paid immediately, with virtually no chance of fraud or erroneous payments.

ValidCheck’s eChecks Integrate with Quickbooks

ValidCheck’s eChecks integrate with Quickbooks to make payment processing and record keeping easier. No double entry of checks into multiple systems, just safe, secure, and fast delivery of payments. You can choose to enter checks directly into Quickbooks and they will automatically be sent through ValidCheck, or enter checks into ValidCheck and those checks will be synced with your Quickbooks company file.